Thiink July Market Update

The outlook for the commercial market is anticipated to be significantly more optimistic for the second half of 2019.

The recent election results and opening of key infrastructure such as the Sydney Metro have all set a positive tone, however with little impact on sale or lease market activity to date. The key factor to ‘lower than typical’ transactions when viewed in comparison to the past 5 years is squarely attributed to restrictions on borrowing and the lack of availability of funds by banks and lenders. In recent weeks have seen examples of the banks become more proactive with lending products, being notably forward and reaching out to clients actively promoting refinancing for discounted rates of up to 1% on previously agreed loans. We believe this is the first move of availability of money to consumers, which we believe will follow through to an increased level of buyer activity over the coming months. The smart money has returned to the market in recent weeks which could likely increase to the general market uplift in sentiment within just a few months, setting the next leg of the upward trend of property prices.

Stock levels remain at record lows, with property owners firmly holding on their investment achieving a healthy 5 – 6% Net return; whilst the banks show less than a third in comparison of 1.5 – 2%.

Increased lending, strong returns and low volume of available property could soon set pressure again on demand and supply fundamentals, signalling the past 6 months low volume activity as temporary. This could signal also signal a general boost to business confidence, that would also positively impact the leasing market as companies regain optimism for future growth plans that will in turn increase rental values and decreasing any short term levels of built up stock.

The industrial market over the same period has been incredibly resilient, and in our opinion has been the best performing property asset class over the past 12 months and will continue to outperform all other property with a critically low levels of land availability for small to medium occupiers across the Sydney marketplace.

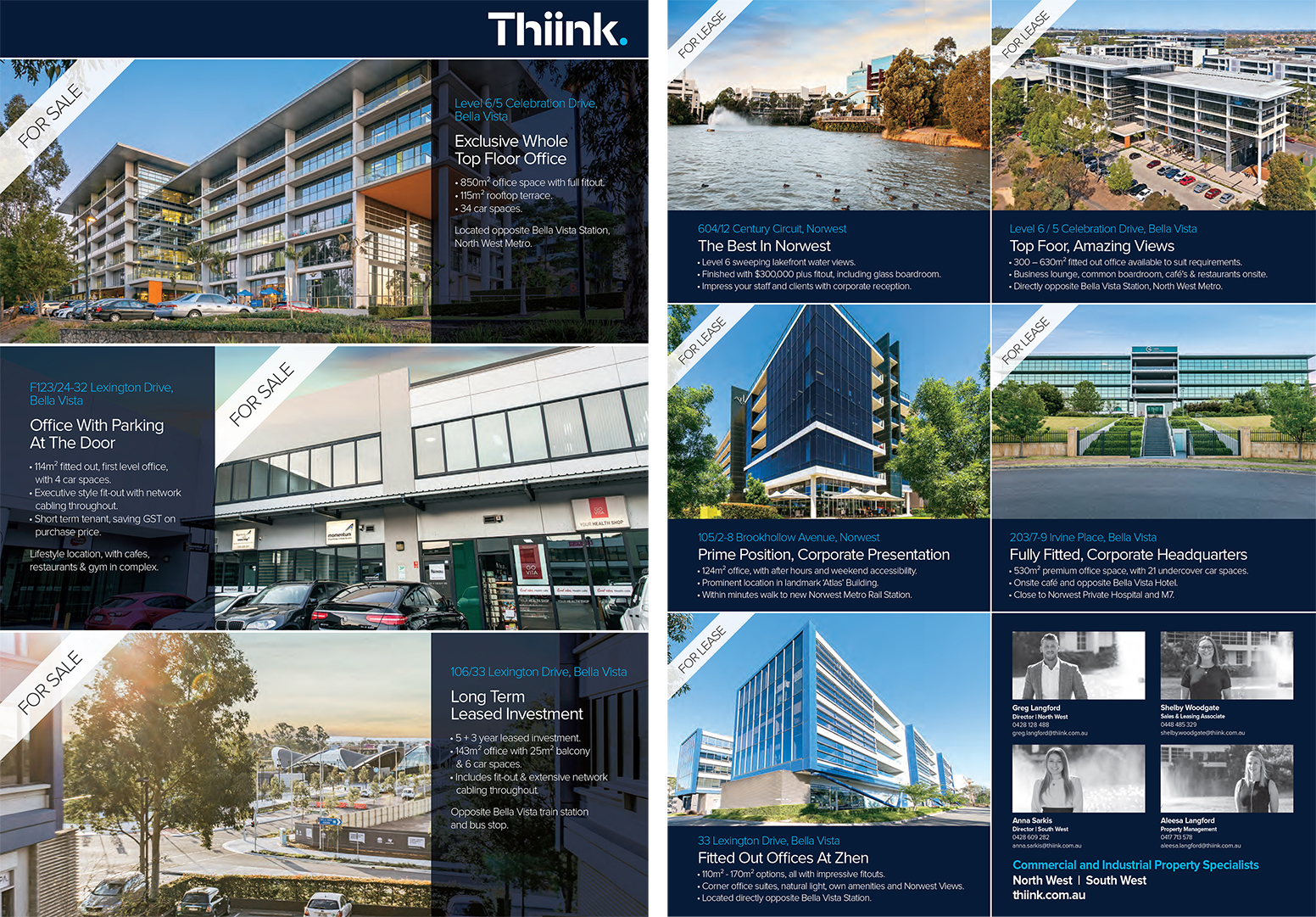

Below is a selection of available commercial office suites, in our July Property Brochure. If you’d like any more information, or wish to inspect any of these properties, please contact Greg Langford on 0428 128 488 or Shelby Woodgate on 0448 485 329.

We invite you to contact Greg Langford on 0428 128 488 to discuss how our team can ‘add value’ to your commercial or industrial property and set the new benchmark for any of your real estate needs for Sales, Leasing or Property Management.

Greg Langford | Director

M 0428 128 488

E greg.langford@thiink.com.au